|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Chapter 13 Bankruptcy Website: A Comprehensive Overview for Financial Relief

Filing for bankruptcy can be a daunting process, but a well-designed Chapter 13 bankruptcy website can provide much-needed guidance and resources. This article explores the benefits and uses of such a website, helping you navigate your financial journey with confidence.

Understanding Chapter 13 Bankruptcy

Chapter 13 bankruptcy, often called a wage earner's plan, allows individuals with a regular income to develop a plan to repay all or part of their debts over three to five years. This can be a viable option for those who want to avoid foreclosure on their homes.

Key Benefits

- Debt Consolidation: Combines debts into one manageable payment.

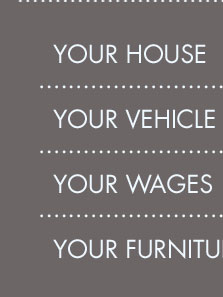

- Asset Protection: Allows you to keep your property while catching up on missed payments.

- Credit Score Impact: Less damaging than Chapter 7 bankruptcy.

Navigating a Chapter 13 Bankruptcy Website

A dedicated Chapter 13 bankruptcy website is a valuable tool for those considering this financial path. These websites offer a wealth of information and resources to assist you every step of the way.

Features to Look For

- User-Friendly Interface: Easy navigation is crucial for finding information quickly.

- Educational Resources: Look for articles, videos, and FAQs that explain the process.

- Legal Assistance: Some websites connect you with bankruptcy attorneys near my location for personalized help.

By utilizing these features, you can better understand the nuances of Chapter 13 bankruptcy and make informed decisions about your financial future.

Comparing Chapter 13 to Other Bankruptcy Types

While Chapter 13 is suitable for many, it's essential to compare it with other options like bankruptcy chapter 7 charlotte nc to determine the best fit for your circumstances.

Pros and Cons

- Chapter 13: Allows debt restructuring, but requires a steady income.

- Chapter 7: Offers a faster resolution by liquidating assets, suitable for those with limited income.

Understanding these differences can guide you toward the most beneficial financial strategy.

FAQs

What is the primary purpose of a Chapter 13 bankruptcy website?

A Chapter 13 bankruptcy website aims to provide comprehensive information, resources, and access to legal assistance, helping individuals understand and navigate the bankruptcy process.

How can a Chapter 13 bankruptcy website assist in debt management?

These websites often offer tools and resources for budgeting, repayment planning, and connecting users with financial advisors or attorneys to help manage and consolidate debt effectively.

What resources are typically available on a Chapter 13 bankruptcy website?

Resources may include educational articles, FAQs, video tutorials, and links to professional legal services specializing in bankruptcy cases.

A Chapter 13 bankruptcy website serves as a crucial resource for individuals seeking financial relief through structured debt repayment, offering tools and guidance to make the process more manageable and less stressful.

Debtors, creditors, and attorneys can view case information online to stay on top of bankruptcy cases. This is a source of comprehensive case and claims data.

How can I find out the REMAINING BALANCE. OWED or PAYOFF AMOUNT FOR MY CHAPTER 13? A. Remaining balance owed and payoff amount is NOT available online at www.

![]()